September 9, 2019

THE FED HAS CHANGED COURSE, GOOD NEWS FOR BORROWERS

by Kirk Ward • Senior Multi-Family Investment Broker

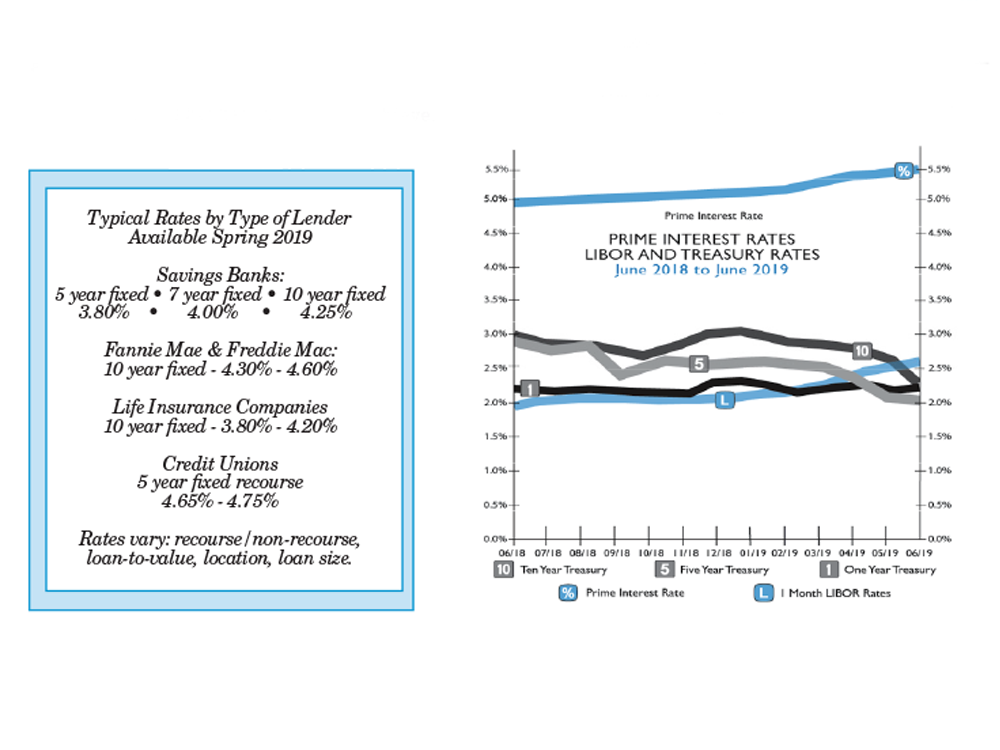

With seven quarter-point increases by the Fed in 2017-2018, the Fed announced in late March it may not raise rates at all during the remainder of 2019.

This reversal in the direction of the Fed is “good news for investors” looking to refinance existing debt or placing new debt on an acquisition. This comes at a time with slower economic growth and tame inflation.

The benchmark 10-year Treasury has dropped from a high of approximately 3.20% in 2018 to approximately 2.1% or lower currently. This has resulted in a nearly flat yield curve and even approached an inverted yield curve between the 1-year and 5-year Treasury. This has led to similar interest rates being quoted for both short-term and long-term loans.

The flat yield curve will reward investors for choosing long-term 10-year fixed rate loan programs over the popular 5 and 7-year fixed rate programs that were popular in the past.

The market is pricing for the probability of a 50% to 70% chance of a rate cut by this time next year. (Currently, the direction of interest rates is certainly downward).

While there are a lot of dollars in the marketplace trying to compete for financing today, those markets with lower cap rates will find higher leverage difficult to achieve.

Currently, non-recourse financing is readily available for most apartment financing today, with the exception of smaller third tier markets and with lower loan amounts.

Investors should keep on top of the Fed and interest rates going forward. The downward pressure on rates will make long term financing even more attractive in the future. Norris & Stevens’ brokers work with a wide variety of lenders and can assist investors with multiple financing options.

Norris & Stevens, Inc., is one of the largest locally-owned, full-service commercial real estate brokerage firms in Oregon and SW Washington. A member of the TCN Worldwide network, the firm was founded in 1966 and currently employs approximately 75 professionals in investment sales, leasing and property management for office, industrial, retail, land and multi-family properties. The firm’s property management portfolio exceeds 5 million square feet of commercial space and over 9,000 apartment units.