September 17, 2019

HOW HAVE PORTLAND METRO APARTMENTS FARED OVER THE LAST TEN YEARS?

by Cameron Mercer • Multi-Family Investment Broker

If you have been an apartment building owner since 2009, you have seen more happen in the Portland apartment investment world than you could have ever imagined. In 2009, we were just coming out of the “Great Recession” which meant that you weren’t really sure what the next day was going to bring. This historic economic downturn brought with it one of the slowest apartment construction periods in history for Portland development from 2000-2010. The local unemployment rate happened to be well over 10% and apartment property values were struggling to stay relatively close to their pre-recession value.

In 2010 the population growth began to tick up quickly for approximately six years in which many of those years, Portland was the #1 city to move to according to the United Van Lines moving company. While Portland had been relatively a “sleepy city” for one of the larger cities on the west coast, this sleepy ideology was soon to be a distant memory. A great example of Portland being woken up was the rent growth increases year on year which jumped up to double digits from 2014-2016.

In 2010, a studio in the northwest Portland neighborhood was approximately $550 for a 450 sf. studio. Fast forward to 2015, that same studio was $1,000. This is a 45% increase in just five years. In today’s market, the average rent for a studio in downtown Portland is $1,144. This is a prime example of rent growth, as rapid in-migration and a lack of supply of apartments brought in a short period of time new rental rates that the city hadn’t seen before.

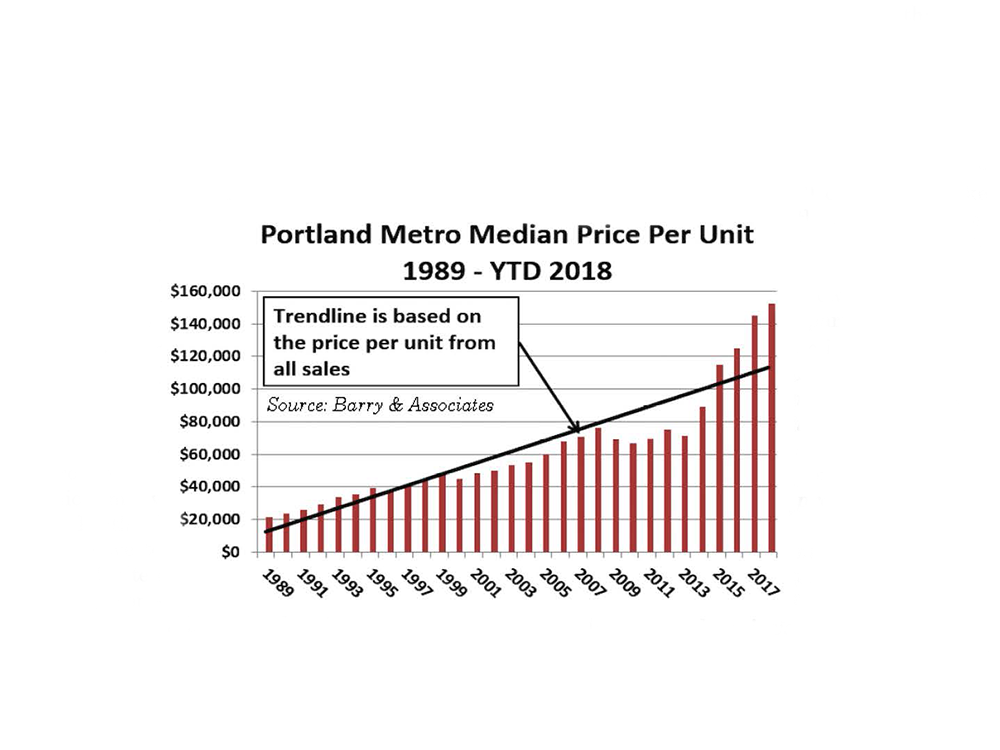

Market rate apartment properties in the Portland metro and in the state of Oregon to an extent, experienced large increases in property values, due to a healthy growth in rents and low vacancies. Many local and national investors took note of the opportunities which led to a spike in sales transactions from 2014-2016. For example, if you bought a garden style 30 unit apartment property in 2013, there was a good chance that you could have doubled your property’s value in 2017 according to a recent Barry & Associates chart shown above.

For Oregonians, it is safe to say that the amount of construction and the economic boom that has occurred in the Portland metro in just the last 5-7 years has been jaw-dropping. Even with all of the new construction, recent property value increases, and continued buyer demand, it’s hard to believe things will continue on like they have been. We have already seen slower rent growth and less apartment transactions in 2018.

If you are thinking about capitalizing on the strong value of your apartment property in this current sellers’ market, let’s review your options. We continue to see low inventory and strong buyer demand which only helps a seller’s bottom line.

Norris & Stevens, Inc., is one of the largest locally-owned, full-service commercial real estate brokerage firms in Oregon and SW Washington. A member of the TCN Worldwide network, the firm was founded in 1966 and currently employs approximately 75 professionals in investment sales, leasing and property management for office, industrial, retail, land and multi-family properties. The firm’s property management portfolio exceeds 5 million square feet of commercial space and over 9,000 apartment units.